At Mitsubishi HC Capital (Thailand) we offer a wide range of finance services for customers and dealers. We can provide a wealth of expertise on a variety of options, which are tailored to your need and backed by a service that’s efficient, responsive and designed give to businesses a competitive edge.

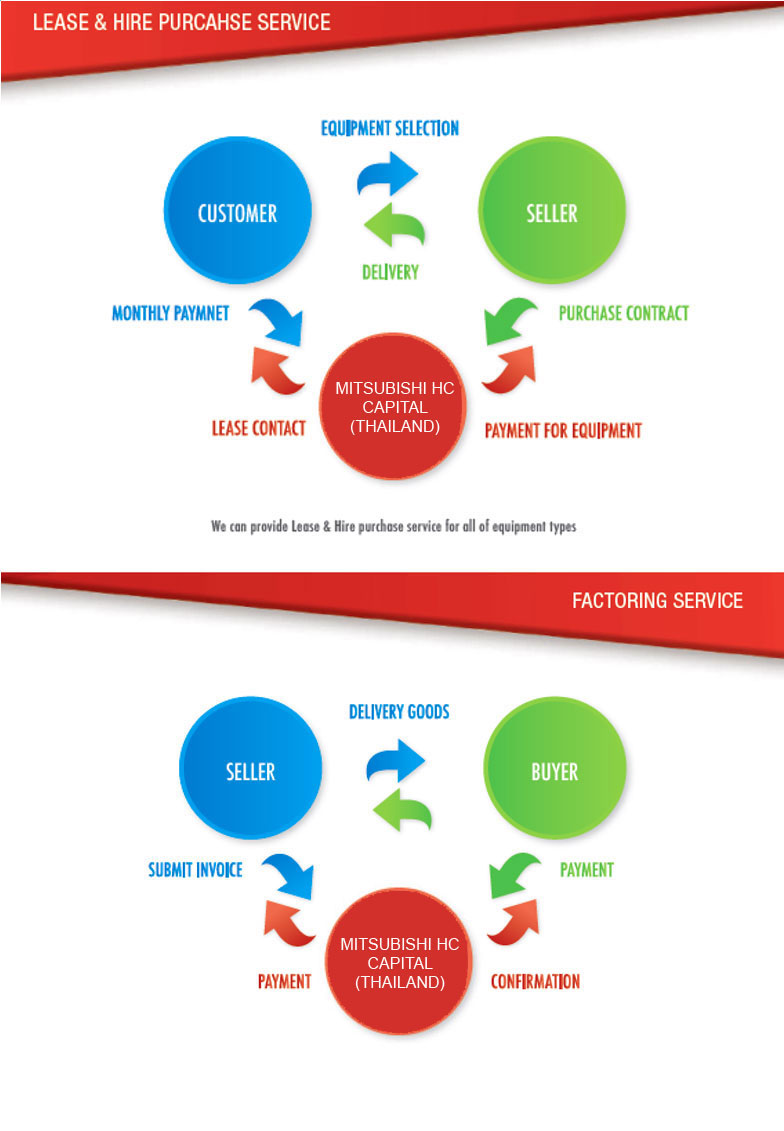

Mitsubishi HC Capital (Thailand) CO., LTD. purchases the equipment from dealers and leases it to the Customers. We have the legal owner of the asset during the duration of the lease. Lease payment is recognized as an expense, beneficial to reducing corporate taxes. No risk of interest rate fluctuation as we provide fixed rate of lease payments during the contract.

Allows a business to spread the cost of purchase and can provide eventual ownership of the asset at the end of the agreement. Hire Purchase help to manage the cash flow as well.

We purchasing machinery and equipment currently owned by a customer and lease the same asset back to the customer. The Sales and Lease back can be flexible and tailored to suit the requirements of the customer. Because this is the leasing so the customer can get the tax benefit as well.

Factoring is short-term loan by converting the seller’s account receivable into cash. We will buy commercial invoice and other trade documents whereby the seller has already submitted or delivered goods/services to the buyer and is in the process of a waiting collection according to commercial credit term of not more than 120 days.

Operating Lease is treated as “off balance sheet” for accounting purposes and therefore doesn’t affect the gearing ratios of a business. Operating Lease is suitable for vehicle and forklift especially including with maintenance service that help you for smoothly operation.